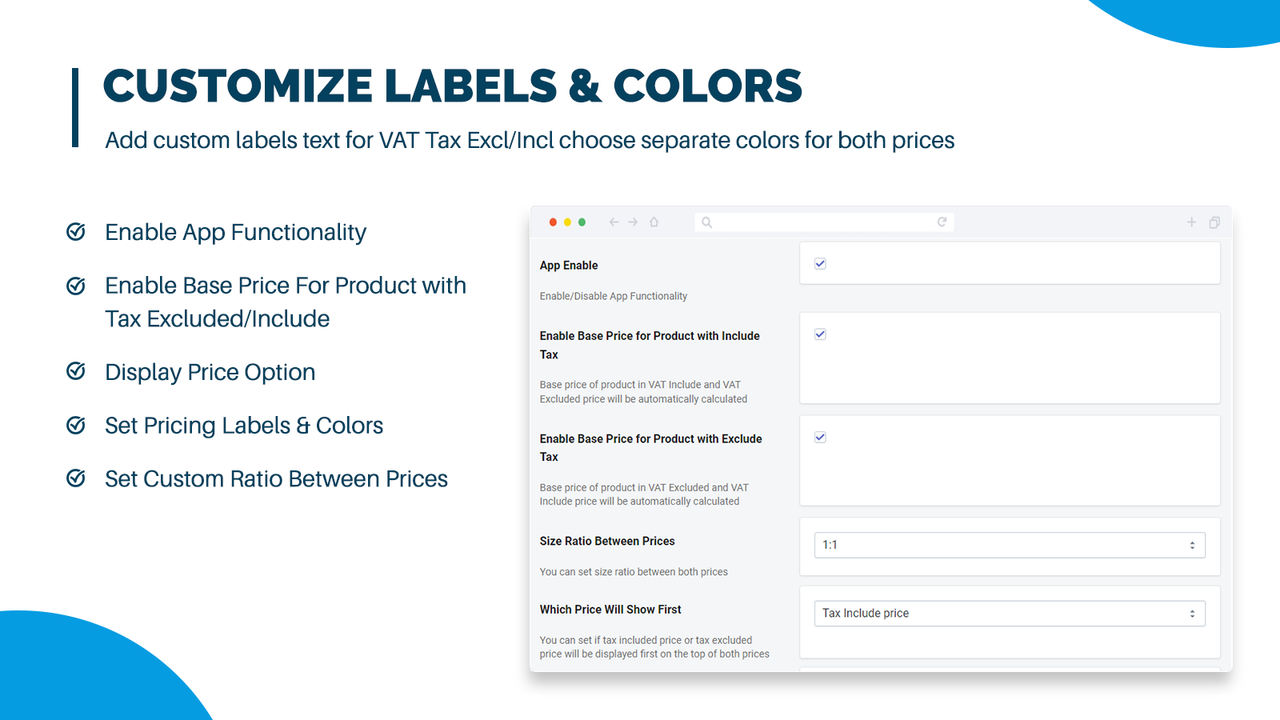

Extendons VAT Dual Pricing - Vat Dual Pricing App - VAT Include & Exclude Pricing | Shopify App Store

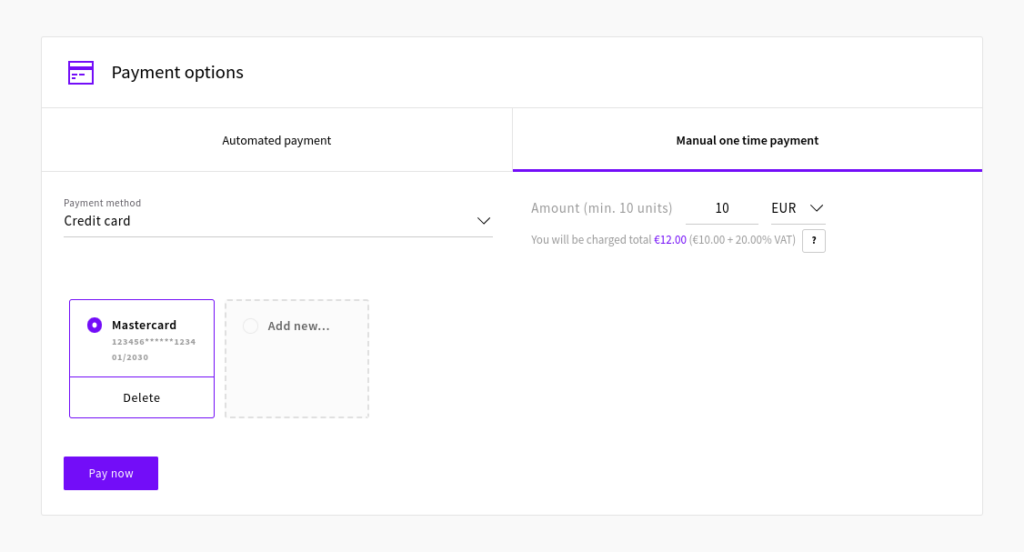

How can I know what the sales tax or value-added tax (VAT) will be on my purchase? – ForeFlight Support

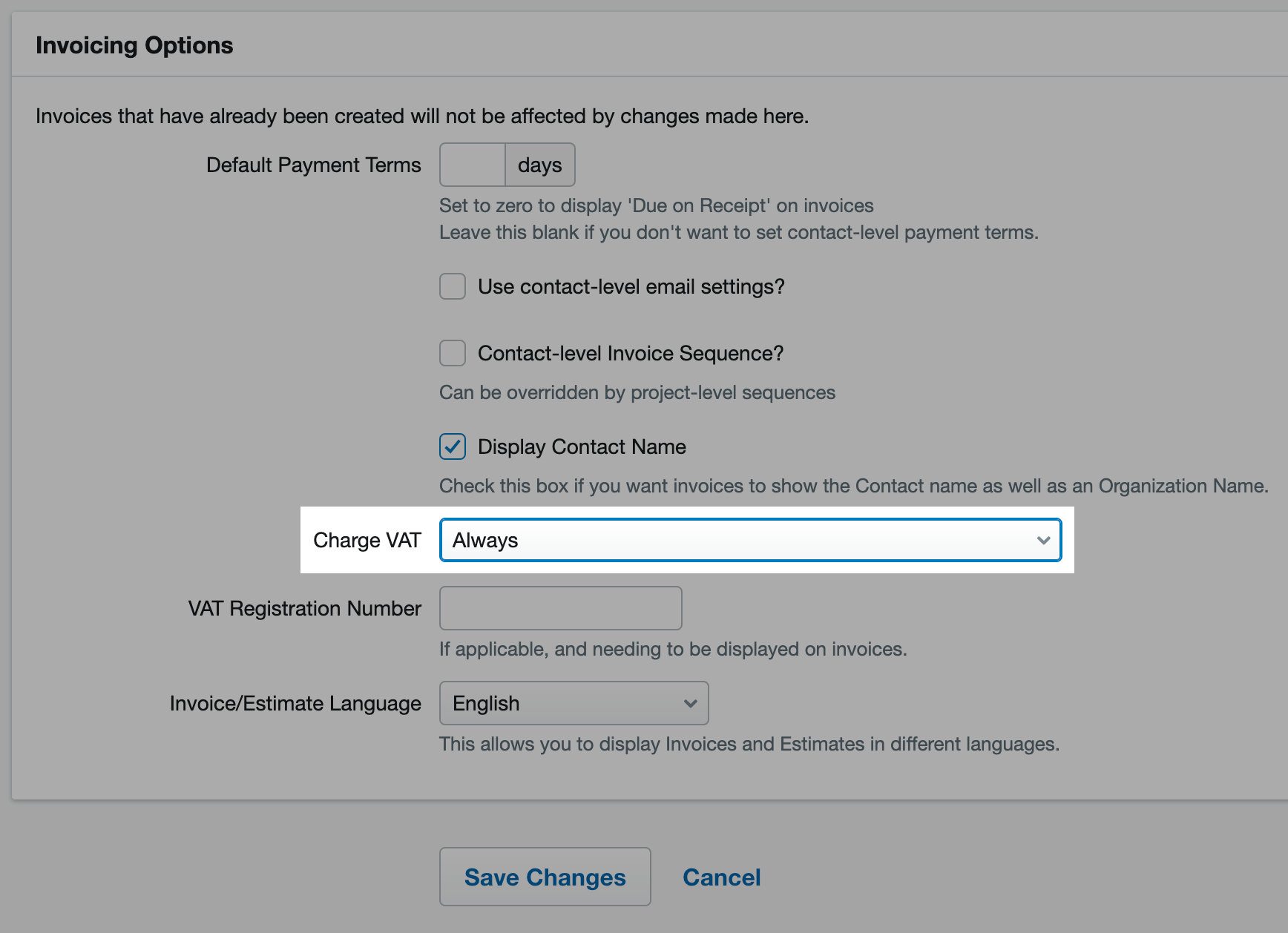

THE VAT CHANGES FOR CROSS-BORDER E-COMMERCE FROM 2021 | by Evaldas Cerkesas | ESAS CONSULTING | Medium

![About the Value Added Tax (VAT) in UKl[Rakuten Global Express] Rakuten's Official International Shipping (Forwarding) Service About the Value Added Tax (VAT) in UKl[Rakuten Global Express] Rakuten's Official International Shipping (Forwarding) Service](https://globalexpress.rakuten.co.jp/help/country/tax/images/GB/en_sp03.svg)

/VAT-Banner-Slider-Banner-en.jpg?rev=91e4f40c1d5c4731b2d0bfd69ac39c2b&hash=0CD0120F0D018C03EA8E4D1DF3D94BE3)